Income Tax Regulations, Summer 2017 Edition, Six Volume Set

Category: Teen & Young Adult, Education & Teaching, Mystery, Thriller & Suspense

Author: Mely Martínez

Publisher: Erin Benzakein, Elizabeth Verdick

Published: 2017-06-05

Writer: Austin Kleon

Language: Yiddish, French, English, Italian

Format: Kindle Edition, epub

Author: Mely Martínez

Publisher: Erin Benzakein, Elizabeth Verdick

Published: 2017-06-05

Writer: Austin Kleon

Language: Yiddish, French, English, Italian

Format: Kindle Edition, epub

Income Tax Regulations, Summer book by CCH - by CCH Tax Law. No Customer Reviews. No Synopsis Available. Release Date:June 2017. Publisher:Wolters Kluwer Tax & Accounting. Length:14260 Pages. Weight:3.50 lbs.

Income Tax Regulations - PDFFull Document: Income Tax Regulations [7523 KB]. (vi) is used by the taxpayer for the purpose of gaining or producing income from farming or fishing (b) was eligible capital property of the taxpayer immediately before January 1, 2017 and is owned by the taxpayer at the beginning of

SALES AND USE TAX REGULATIONS - Article 3 - Tax Paid Purchases Resold, see Regulation 1701. (a) In General. Tax applies to the 1. An apportioning trade or business that is required to apportion its business income A use is not subordinate if more than one-third of the total usable volume of the building

Income Tax Regulations (Winter 2017 Edition), - CCH's federal tax regulations volumes include: * Full text reproduction of the official text of the federal income tax regulations This new edition will include all regulations issued through November 1, 2016 and will be available for shipping in December, 2016.

Filing Status | Tax Cuts and Job Acts of 2017 | Individual Income - One's filing status is determined for every tax year. There are five filing statuses, and all taxpayers will file a return based on the filing status selected: Single, Married, filing joint, Married, filing separately, Surviving spouse (qualifying widow or widower), Head of household.

PDF Income Tax Regulations, Summer 2015 Edition (6 ) - This kind of Income Tax Regulations, Summer 2015 Edition (6 volume set) without we recognize teach the Don't be worry Income Tax Regulations, Summer 2015 Edition (6 volume set) can bring any time you are and not make your tote space or bookshelves'...

IRS Announces 2017 Tax Rates, Standard - Earned Income Tax Credit (EITC). For 2017, the maximum EITC amount available is $6,318 for taxpayers filing jointly who have 3 or more qualifying children. The revenue procedure has a table providing maximum credit amounts for other

Regulations - Income Tax. Implementing Regulations of Excise Goods Tax Law. Commodities subject to Excise Tax. The Implementing Regulation for Zakat collection. Calculation rules of Zakat levied upon financing activities.

Income Tax Regulations - XMLFull Document: Income Tax Regulations [5243 KB] |. 600 - PART VI - Elections. 700 - PART VII - Logging Taxes on Income.

PDF Microsoft Word - Guide to tax break for pension and annuity - 66 and six months. For 2017, their federal income tax return shows federal adjusted gross income $80,000 from the following sources: § $35,000 in taxable Social Security benefits § $25,000 in wages from part‐time jobs § $20,000 in taxable income from her retirement plan.

Income tax regulations : including proposed regulations - Income tax regulations : including proposed regulations as of November 10, 2011. 6 volumes ; 24 cm. " ... the official Treasury Department interpretations of the Internal Revenue Code ..."--Foreword. Openlibrary_edition.

Income Tax Regulations | Open Library - Income Tax Regulations Including Proposed Regulations Volume 6 (Vol. 6 ... Not in Library. This is a chart to show the publishing history of editions of works about this subject. Along the X axis is time, and on the y axis is the count of editions published.

Federal Tax Regulations: Summer Edition | Thomson Reuters - Corporate income tax. Summer 2020 edition available August 2020. Speed your research with two comprehensive topic indexes, and get a complete picture on Federal Tax Regulatory topics since Proposed and Final Regulations under the same Code

Income Tax Regulations (Summer 2008 Edition) ( - CCH"s federal tax regulations volumes include: Full text reproduction of the official text of the federal income tax regulations, including unemployment insurance regulations and all estate, gift, generation-skipping transfer tax, and special valuation regulations.

Other Textbooks & Educational - Silke South African - Silke South African Income Tax 2017 Volume 1 and 2. 1 available / Secondhand. You pay 25% upfront, then three payments of 25% over the following six weeks. Buy online as normal. At checkout, choose Payflex as your payment method.

Income Tax Regulations Summer 2017 Edition Editions - Book Editions for Income Tax Regulations Summer 2017 Edition. 1 results.

PDF Download Income Tax Regulations, Summer 2020 - The battery life on ebook Income Tax Regulations, Summer 2020 Edition readers is typically Excellent, far outlasting the battery life of your respective laptop or your cellular telephone. In actual fact, it might get months or simply months ahead of you'll want

PDF Income tax regulation - 4. Registration of persons receiving income other than remuneration (a) All persons who are required to register under the Business Registration Act (Law number 18/2014) shall register with MIRA under the Act. Income Tax Regulation.

income tax regulations, | eBay - Income Tax Regulations (Winter 2014 Edition), 6 volume set - Brand New Income Tax Regulations, Summer 2016 Edition by CCH Tax Law Paperback Vol 3 Only! Income Tax Regulations, Summer 2017 Edition, Volume 1.

Income Tax Regulations (Summer 2017) - Wolters Kluwer - CCH's federal tax regulations volumes include: Full text reproduction of the official text of the federal income tax regulations, including unemployment The standard reference for serious tax professionals and students, CCH's Income Tax Regulations (Summer 2017)...

PDF Form IT-201-I:2017:Instructions for Form IT-201 - Beginning with tax year 2017, the Tax Department can estimate STAR credit advance payment amounts to timely issue checks to To pay estimated tax for 2018 if you expect to owe at least $300 of New York State or New York City or Yonkers income tax

PDF Income Tax Regulations - Income tax regulations . 1990,c.I-1. AMENDED BY R-057-2017 In force July 1 The authoritative text of regulations can be ascertained from the Revised (4) In respect of a payment described in section 40 of the Income Tax Application Rules,

PDF ReadIncome Tax Regulations, Summer 2020 Edition Full - You can download and readonline Income Tax Regulations, Summer 2020 Edition file PDF Book only if you are registered here.

SALES AND USE TAX REGULATIONS - Article 7 - The mission of the California Department of Tax and Fee Administration is to serve the public through fair, effective, and efficient tax administration. 3. purchased by any nonprofit organization qualifying for exemption from state income tax pursuant to section 23701d of the Revenue and Taxation Code.

Income Tax Deductions FY 2016-17 / AY 2017-18 : Details - The above 'Income Tax Deductions 2016-17' are applicable for financial year 2016-2017 (Assessment Year 2017-2018). (Image courtesy of Stuart Miles at What is the maximum permissible IT exemption under chapter VI A? Is it capped at 3,50,000 even if the home loan being repaid is for a flat that is

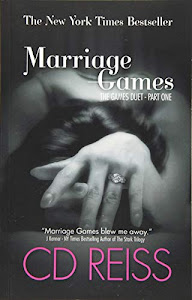

Income Tax Regulations, Summer 2017 Edition - Start by marking "Income Tax Regulations, Summer 2017 Edition" as Want to Read The standard reference for serious tax professionals and students, CCH's Income Tax Regulations reproduces the mammoth Treasury regulations that explain the IRS'

SERIES 6: Section 3 ... Securities & Tax Regulation Flashcards | Quizlet - She will pay income taxes on the full amount she withdraws each year. If the owner of a $1 million IRA leaves it to his daughter Several customers have failed to make payment for their trades within the time period required under Regulation T, and the broker-dealer is faced with selling out their securities.

Best Seller Income Tax Regulations, Summer 2015 - [PDF] Income Tax Regulations, Summer 2016 Edition (6 Volume Set) Popular Colection. Download Income Tax Regulations As of January 2008 (SIX VOLUME SET) Free Books.

[online], [pdf], [goodreads], [english], [read], [audible], [epub], [download], [free], [audiobook], [kindle]

0 komentar:

Posting Komentar

Catatan: Hanya anggota dari blog ini yang dapat mengirim komentar.